Stay Curious, Be Adaptable: A Profile of Sanjay Patel OE

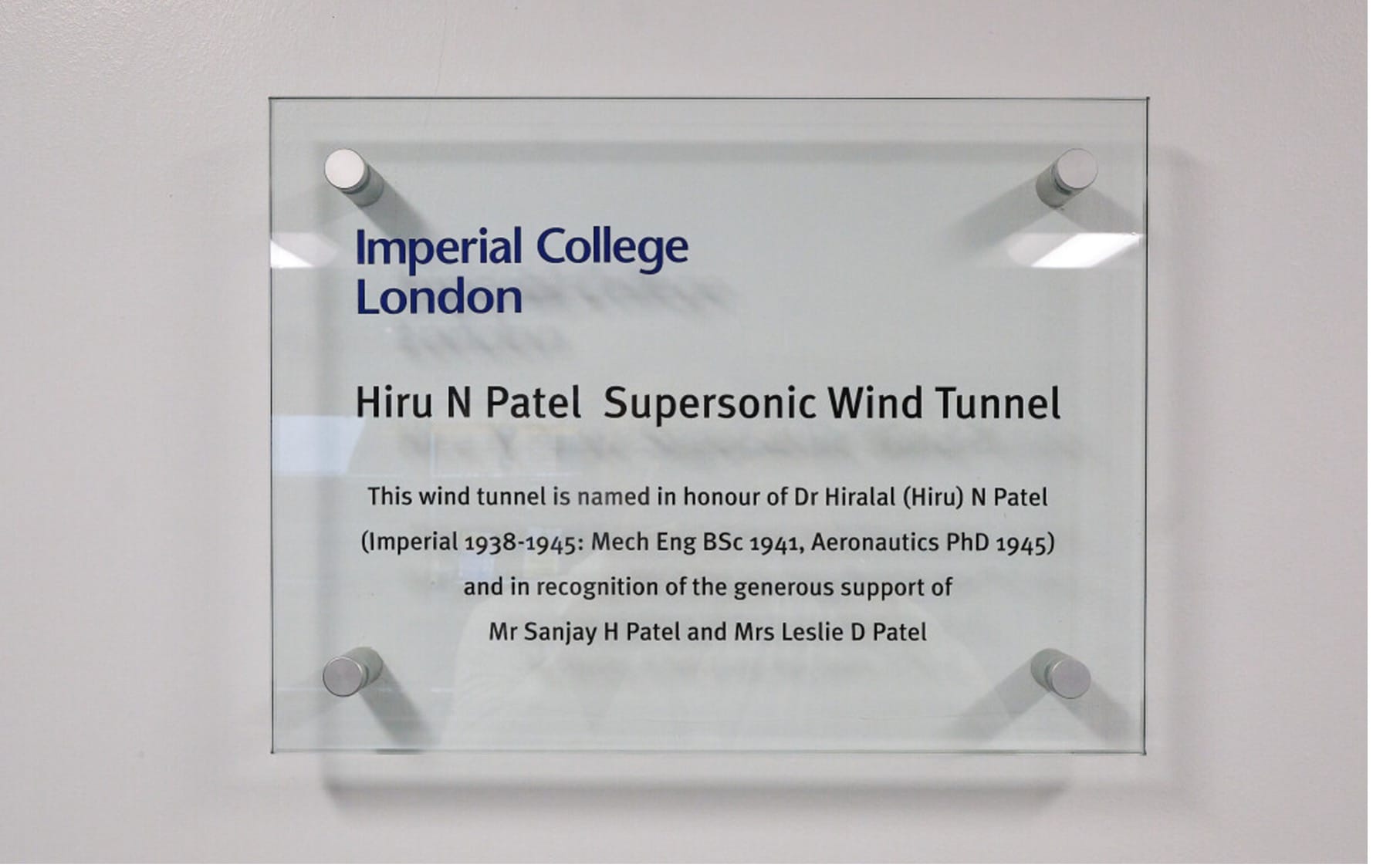

Sanjay Patel and his wife Leslie were involved in the rebuilding of a wind tunnel. That I couldn’t grab a second to ask why indicates the pace of a Sanjay Patel conversation. He’s a whirlwind of insight, brilliance and empathy, his thoughts speeding far ahead of one’s own. He spoke at Keynes Society on 22 May. I had the privilege of interviewing him for EtonSTEM a few days later.

Patel is a Partner and Senior Advisor of Apollo Global Management, one of the world’s most successful private equity investment firms. He’s served as Chair of the Eton Development Committee, on the Investment Committee of the Eton College Foundation, and recently hosted the relaunch of the American Friends of Eton College in New York City. He’s served on the Board of Overseers of Harvard University and the Stanford Graduate School of Business Advisory Council, in leadership roles in numerous official, professional and charitable institutions in the UK, the US and India.

I wanted to learn about his academic and professional trajectory from STEM to finance to the environment, and his personal journey from bursary recipient to successful global investor to philanthropist. His is a great story which starts here with his days as an Eton boy on a full bursary. [Quotes edited for conciseness and clarity.]

TG: When you started at Eton or even before you came to England, did you have an idea of what you wanted to do or a reason for being ambitious, or were you following a set path?

SP: I came from India where humanities was not frowned upon but viewed as less practical. I came in ’74, and at the time you picked one lane for your A-Levels: the humanities or the sciences. Although, in fairness, my parents never told me to do one or the other. Now, when I ask people what they’re doing at A-Levels there’s definitely much more mixing between humanities and sciences than there was 50 years ago.

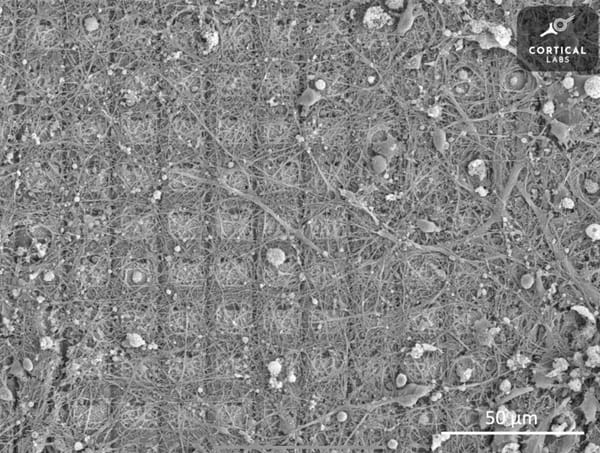

Patel speaks with great respect and affection about his parents. Patel’s father had come from India as a young man in 1938 to work and to study aeronautical engineering. He spent the war years in London. When he returned to India in 1945, he found there weren’t any jobs for aeronautical engineers there. Instead, he worked for a British producer of Bakelite plastic as a businessman and CEO.

SP: I had that as a backdrop. Someone who did a focused engineering degree and ending up never using it and instead building a career in business.

TG: So, it gave you some reassurance?

SP: Yes. Picking a science didn’t mean I was going to become a scientist. But I felt it was a great training of the mind. I thought I was great at maths and English. I did five A-Levels: Maths, Further Maths, Physics, Chemistry and Biology. I was in that world. I left to go to college in the US because I needed financial aid, but I felt, honestly, liberal arts training was appealing. If you went to Cambridge, you read just one thing for three years, which, in my case, was going to be science. The idea of being able to do Economics or Art was appealing.

TG: But once you were at Harvard, was there anything else that you were involved in or that you found very engaging? Was it just the liberal arts education itself or were there any extracurricular activities that you did?

SP: I was involved in a lot of societies at Eton, which was great.* I did the Keynes Society. I did the Wotton’s Society. I did sport. I didn’t do stuff like The Chronicle. What you end up doing at Harvard, is there’s a lot of “comping” (competing) for different places. I joined The Advocate, which is the literary magazine, and a lot of extracurricular athletics and social stuff. I was trying to have a broad experience. In my first year I did a lot of (classes in) History, Economics, Math and Science, so I kind of knew where I was heading.

*Patel neglects to mention he was a member of Pop.

TG: While you did [extracurriculars] at Eton which weren’t necessarily related to your A-Levels, did the liberal arts education at Harvard make you think you wanted to do maths and science a little less?

SP: For sure. The way your academic life works, you have to take hard core courses and I think you do start to reflect. The fact that I went through the process of testing out what else I liked was a really healthy thing.

Patel received his AB and SM engineering degrees magna cum laude from Harvard in 1983. He applied and was accepted into Harvard Business School’s MBA programme to begin in September 1983, which was very unusual. Applicants are normally expected to get a year or two of work experience before applying to a top MBA programme. Patel decided he’d get more out of an MBA with work experience first and got his MBA from Stanford instead a few years later. The decision to go to work first changed his career path dramatically.

While still an undergraduate at Harvard, Patel had applied for a summer job through Students for Educational Opportunity (SEO), an organisation with the mission of increasing diversity on Wall Street. He was given a summer job doing computer programming at Credit Suisse-First Boston because of his related studies at Harvard. When he graduated from Harvard, he was ready for Wall Street.

SP: If you were coming out of college at the time, there was definitely a demand for those seats and it felt like having worked at CS (Credit Suisse), why not try to give it a shot? It was, to be honest, a really well-paying job and so the shift from engineering was more into the world of business, as opposed to finance. I was in M&A - mergers and acquisitions - because Private Equity was barely around then.

TG: And do you think the problem-solving skills from engineering and maths transitioned well into finance and business?

SP: Totally. The strength of STEM education is the ability to problem solve. Obviously, you’re reasonably adept at numbers so if someone throws a balance sheet at you, and you’ve never seen a balance sheet – I hadn’t – you’re not going to get thrown. The ability to actually analyse things - it’s a great training.

Like Patel in his youth, boys at Eton may not be familiar with the language of business, technology, finance or investors. I wasn’t, so I looked up some terms which might illuminate the next parts of the interview…

ESG stands for Environmental, Social, and Governance. It is a framework used to assess a company's performance and practices related to sustainability and ethical issues. ESG is a way to measure a company's non-financial impact.

IBOR stands for Investment Book of Record. This refers to a system that provides a central, consolidated view of an investment firm's positions and exposures. It helps one track performance, manage risk, and make informed investment decisions.

Agentic AI refers to a type of artificial intelligence system that operates autonomously, making decisions and performing tasks without constant human intervention. These systems are designed to adapt in real-time, solve multi-step problems, and utilize complex reasoning, often leveraging large language models (LLMs) and multiple AI agents. Agentic AI systems are proactive and can collaborate with each other to achieve complex goals.

TG: There’s a perception that investors on Wall Street only care about financial outcomes like shareholder value or stock price; has that changed over time? What’s your view?

SP: If you’re running a business, you have a ton of constituencies – you have shareholders, employees, customers. And then you’ve got social issues and the world that you live in and where you sit in the ecosystem of business, so if you’re running a business, you’ve got to think about more than just increasing shareholder value. If you’re in the investment business – pension funds, endowments –you want to be thoughtful about the things you’re doing. It could be saying “We don’t want you to invest in any company that sells tobacco, firearms, or fossil fuels”. If they’re your customers, you’re not doing it. They’re saying things like “Is this company impacting climate?”. So, the world’s not black and white anymore. There’s lots of shades of grey.

TG: Are investment principals like ESG taken into account fully or is it on a case-by-case basis?

SP: It still tends to be on a case-by-case basis. Now every investment committee memo has a focus on ESG, IBOR, and add AI to the list. We started about 10 years ago, focusing on ESG stuff. Maybe five years ago, you added IBOR and two years ago, added AI.

TG: You spoke briefly about AI when you spoke at Eton. How do you think investing in AI should be perceived?

SP: I think it’s a long-term gain. If you look at AI agentic products that are making AI more efficient, the adoption of those products is going to make businesses more effective, more efficient, work smarter. These are the early days on the benefits of AI. If you look at language models, looking at how people are navigating lives using LLM models, you know, there’s dangers lurking everywhere.

SP: I think it’s no different from - you’re not going to believe this, but I had a slide rule when I was at Eton. Do you know what a slide rule is? Go and Google what a slide rule was… It was our calculator.

TG: (Googles “Slide rule”.) I’ve never seen that.

SP: That is in my lifetime. It’s a computing tool. I went from that to calculators by A-Levels, but we couldn’t take them into the exams. I arrived at Wall Street and we didn’t have laptops on the desks. We had one computer in the back room. The first Macs arrived when I went to business school. So that’s the trajectory. So, I’m looking at that trajectory of technology and applications of that technology. You need controls but these are early days.

TG: If people harness the power of AI and use it to invest, how do you think the investment landscape will change in the next 10-20 years?

SP: I think the biggest thing that’s going to happen is access. Remember, if you were an investor, you typically owned stocks, and stocks in your 401ks. Banks did credit. Then there was a bond market in credit and people started owning bonds, and so you had stocks and bonds. Over the last 30 or 40 years, we’ve started doing these things called illiquids, alternatives - and today there’s 13 trillion of illiquid stuff compared to 300 trillion of stuff in the world. I think illiquids are going to increase and access to them, because why should the only people allowed to invest in illiquids be what’s viewed as sophisticated investors? The world is full of illiquid assets. For most people, the largest investment they ever make is the most illiquid thing in the world. What is that?

TG: Children?

SP: Good one. No, real estate. If you don’t have a lot of money, you tend to invest in a house. That house is worth whatever it’s worth the day you buy it, and whatever it’s worth the day you sell it. There’s no liquidity in between for real estate and it tends to be the largest asset someone has. It’s the largest asset class in the world which is the most illiquid asset class in the world.

TG: Do you think there’s going to be a shift away from that?

SP: No, there’s big debate about your generation saying, if you had taken all that money and put it into stocks over the last 40 years and instead rented, you probably were better off. I think it’s a super interesting topic. Your generation is saying, yeah, why should I be tied down to one house?

Sanjay Patel is known as a tireless and generous philanthropist. He and his wife Leslie don’t just donate funding, they give their time and expertise to help charities define and achieve their goals. He explains that the ethos in the US, where he’s based, is that charitable endeavours are a good thing. Business leaders, including at Apollo or Goldman Sachs, where he has worked, discuss philanthropy a lot. Patel believes that not only is it important to give back, but it’s also critical to have balance in one’s life. He sees philanthropy as a way to keep his brain engaged in something other than just work.

TG: I wonder if you could share what you’ve done with philanthropy and your views on volunteering, social action, that aspect of life?

SP: I’ve focused on different buckets. Firstly, education, because I had such a great education. I went to Eton for free. I went to Harvard for free. You pay it forward, paying it back. I felt – obligation is too strong a word – but that education was obvious. So, I’ve been super involved with Eton, Harvard. Stanford - a little less so because I was there later in life, but also all the schools our kids went to - I was involved. Brearley School in New York, the American School in London and a start-up college for girls in Bangladesh. We were involved in the Private Equity Foundation in London, which set up an entity helping NEETs – N-E-E-T – “Not in Education, Employment, or Training", so youth education in the UK. We spent a lot of time on that. My portfolio has changed over the years. Education has always been a chunk of that portfolio. I’ve shifted my focus depending on organisations and I’ve been involved in a lot of organisations.

Over time, Patel’s focus has increased from education to include the environment. He says protecting our planet and life on it seems a most urgent issue to him. He’s spending more and more time on climate-related initiatives.

TG: Is there one piece of philanthropy that you’ve done that you’re most proud of or that you think has been most rewarding or most impactful?

SP: That’s a really good question. I’ve gotten quite involved with the Nature Conservancy. I go back to India a lot, but one of the biggest challenges in India is the environment, so I spend time on that. In the US, the Theodore Roosevelt Conservation Partnership. Teddy Roosevelt was really focused on conservation in the United States. I try to spend time on that. And I’m involved with the Royal Foundation of the Prince and Princess of Wales which focuses on climate with the EarthShot Prize. I’ve done some work on the EarthShot Prize, and also on ivory trade in Africa.

It would have been a shame to waste this opportunity, so I asked the following question.

TG: If you could give one piece of advice to Eton boys, about anything, now, what would it be?

SP: Number 1, be curious about the world. Think very broadly, because no matter what you’re studying now, you may end up in a very different place. Being academically curious gives you the ability to move around in the future. And being adaptable and flexible. Don’t get too dogmatic, because the world can move very fast around you, so I think adaptability and resilience are very important.

Oh, about the wind tunnel… Sanjay and Leslie Patel gave a gift to Imperial College to help the rebuilding of the wind tunnel in thanks for, and to honour the memory of Sanjay Patel’s father who earned his degree in aeronautical engineering at Imperial all those years ago. It’s called the “Dr. Hiru N. Patel Supersonic Wind Tunnel”.

Image sources:

F1: Sanjay Patel, Gaja Capital.

Available at: https://gajacapital.com/team/sanjay-patel (Accessed: 30 June 2025).

F2: Sanjay Patel - Apollo Global Management Inc. - LinkedIn.

Available at: https://www.linkedin.com/in/sanjay-patel-25672313a/ (Accessed: 4 June 2025).

F3: Courtesy of Apollo Global Management.

F4: Courtesy of Apollo Global Management.

F5: Roberts, M. (2016) Generous gift honouring alumnus Dr Hiralal Patel will fund bespoke wind tunnel: Imperial News: Imperial College London.

Available at: https://www.imperial.ac.uk/news/171749/generous-gift-honouring-alumnus-dr-hiralal/ (Accessed: 4 June 2025).

F6: Slide Rule Scale (2025) Wikipedia.

Available at: https://en.wikipedia.org/wiki/Slide_rule_scale (Accessed: 4 June 2025).

F7: Khan, A. (2023) Supersonic Wind Tunnel facility launched at Imperial: Imperial News: Imperial College London.

Available at: https://www.imperial.ac.uk/news/248577/supersonic-wind-tunnel-facility-launched-imperial/ (Accessed: 4 June 2025).

F8: Khan, A. (2023) Supersonic Wind Tunnel facility launched at Imperial: Imperial News: Imperial College London.

Available at: https://www.imperial.ac.uk/news/248577/supersonic-wind-tunnel-facility-launched-imperial/ (Accessed: 4 June 2025).